America’s growing and aging population has financial experts raising concerns about the impact on the Social Security system, for which the number of claimants is also increasing.

The US population has grown by over 103 million over the past five decades, and data from the Social Security Administration (SSA) show that the percentage of Social Security claimants has increased by more than seven percent in that time.

Read more: Checking account vs. Savings Account: Which is Best for You?

said the SSA Newsweek it expects to have 89.9 million beneficiaries in 2053, compared to 67 million beneficiaries at the end of 2023. “That 22.8 million [increase] It specifically contributes to the aging of the baby boom generation past the ages at which retirement benefits are typically claimed (62-70) and lower birth rates after 1964,” said an SSA spokesperson.

Compared to a projected US population of 393 million, the beneficiary-to-population ratio would be 22.9 percent, up from 15.7 percent at the end of 2023.

And the growing number of claimants, especially those who are out of work and retired, means there are fewer workers paying taxes going into the coffers that fund the SSA.

Read more: The best place for short-term investment: CD vs. High Yield Savings Account

Chris Orestis, president of Retirement Genius, told Newsweek: “Historically it has taken about two workers to support one retiree on Social Security, but the ratio has been cut and the program’s fiscal strength is being undermined.”

“A large number of retirees is not the problem in itself; the ratio of retirees to young workers is the problem,” Ron Hetrick, senior labor economist at market analytics firm Lightcast, told Newsweek. “That’s because when people retire, their demand for goods and services remains high, but now we’ll have significantly fewer people to provide those goods and services going forward.”

Photo Illustration by Newsweek/Getty Images

The number of pension claimants has increased from 16.5 million in 1970 to 52.7 million in 2023 – an increase from 8.2 percent to 15.7 percent of the population. The US Census Bureau has also predicted that by 2030, one in five Americans will be older than 65. It says that after 2030, “the US population is projected to grow slowly, age significantly, and become more racially and ethnically diverse.” in line with the increase in immigration.

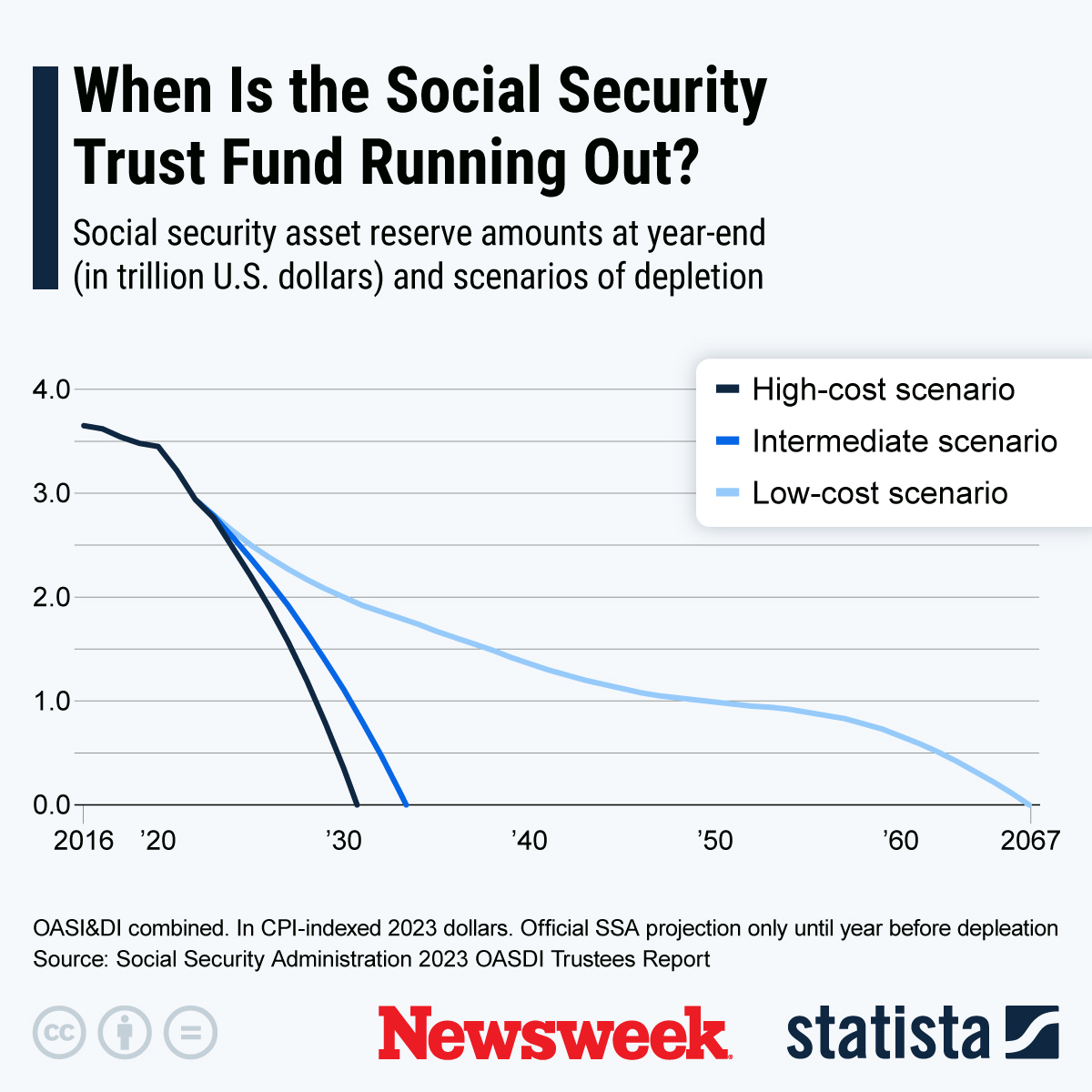

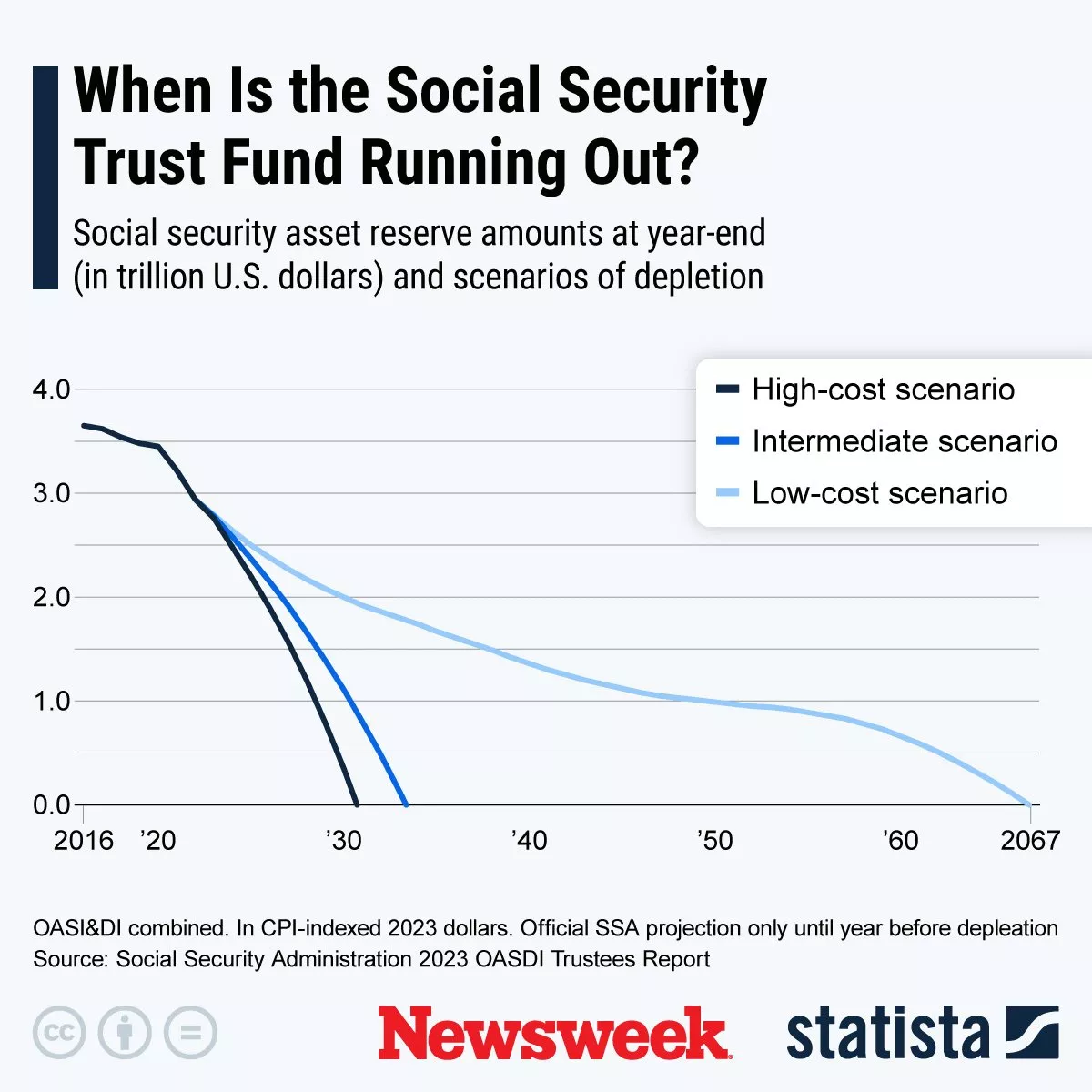

The increase in claimants that comes naturally with an aging population comes at a time when the SSA is already facing a funding stab in just over a decade. The expected retirement date of the Old Age, Survivors and Disability Insurance (OASDI) program has been pushed back to 2035, based on combined pension and disability benefit fund reserves – one more year later than previously anticipated.

If the funds run out, meaning benefits will be paid using only tax receipts, the SSA projects that in 2035 there would be enough money to pay 83 percent of scheduled benefits at current rates.

“It is possible that if the number of retirees continues to grow at a higher rate than expected, the funding cliff could occur earlier than 2034/5,” said Michael Collins, CFA and founder and CEO of WinCap Financial. Newsweek. “This will depend on several factors such as the rate of growth of the retiree population, changes in Social Security eligibility and benefits, and overall market conditions.”

Stephen Kates, chief financial analyst for RetireGuide.com, said the growing number of retirees is “unlikely to accelerate the funding shortfall” given that he anticipates “this increase in retirees and Social Security claimants” based on current assumptions in regarding “tax income, average age of claims, disability claims and life expectancy of benefit recipients.” However, he warned that “if any of these assumptions change, it will affect the forecasts.”

extra

In 1970, the total number of Social Security claimants was 25,700,924—making up 12.6 percent of all US residents. In 2023, the number of claimants reached 67,076,966. A midpoint (June 1) population projection from the U.S. Census Bureau suggests that 20 percent of the population—or one-fifth of all Americans—are currently receiving benefits.

During 2023, SSA spent $1.4 trillion in direct payments to beneficiaries. The Population Reference Bureau estimates that Social Security and Medicare spending will increase from a combined 9.1 percent of gross domestic product in 2023 to 11.5 percent by 2035 due to the “large proportion of older adults” in the population. .

Update 06/16/24 11:04 am ET: This article was updated with comment from the SSA.

Unusual knowledge

Newsweek is dedicated to challenging conventional wisdom and finding connections in search of common ground.

Newsweek is dedicated to challenging conventional wisdom and finding connections in search of common ground.

#Social #Security #Warning #Population #Shift

Image Source : www.newsweek.com